Oriental Focus Fund: A highly profitable and fast-growing portfolio

Lower interest rates, a weaker Dollar and improving shareholder returns lie ahead

After several years of minimal or disappointing returns, 2025 is proving a better year for the Asia ex Japan asset class despite the onslaught of Trump’s tariffs. The regional index is comfortably ahead of the world index at the time of drafting this article.

The EPIC Oriental Focus Fund (“EOFF”) has trailed the index thus far this year following a difficult period in April when the Trump trade policies hit the region, but longer term performance remains satisfactory: in the five years to 29 August 2025 the US Dollar B share class has compounded at 6.83%, well ahead of the 4.73% compound return of the regional index.

A highly profitable and fast-growing portfolio

This article updates previous articles published over the last few years which have highlighted the underlying profitability of the holdings in the Fund. The profitability data was sourced from Bloomberg on 15th September 2025.

The charts above confirm the vastly superior profitability of the fund’s portfolio compared to the Asian universe. The weighted average return on equity of the portfolio stands at 24.1%, double the 11.9% return on equity of the regional index, while EOFF’s weighted return on capital, at 19.7%, is almost five times higher than that of the index (4.7%).

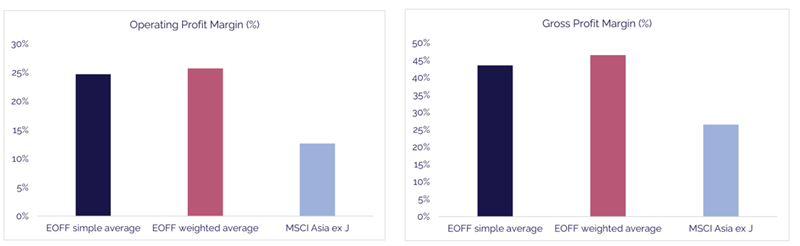

Unsurprisingly this superior profitability is evident in margins. The fund’s weighted operating profit margin of 25.7% is roughly twice that of the universe (12.6%), while the 46.5% gross profit margin exceeds the universe’s average of 26.5% by a considerable distance.

The fact that the simple average numbers on these metrics for the portfolio are a little lower than the weighted average confirms that our larger, higher conviction holdings have a superior profitability profile, as one would expect. The top ten holdings account for c.55% of the portfolio, and the average holding period for these ten stocks stands at over eight years.

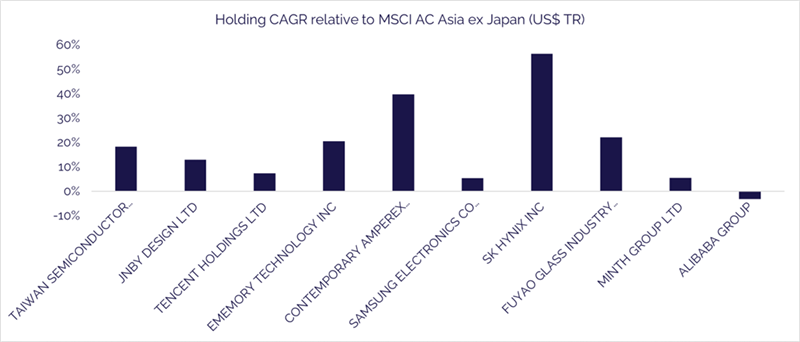

Of the top ten positions, only Alibaba has failed to generate outperformance relative to the index since purchase.

Growth and valuations

In addition to profitability, we remain very focussed on the potential growth of every portfolio holding. The simple average five-year revenue growth of the portfolio holdings stands at just over 18% per annum, well in excess of nominal GDP around the region.

Conclusion

Investing in highly profitable and fast-growing companies does, unfortunately, come at a cost. In our last paper we noted that the portfolio traded at a significant premium to the regional index on a price to earnings ratio comparison. Interestingly, this premium has shrunk significantly over the past twelve months. Our portfolio is still trading on 22x earnings (more or less unchanged from last September) while the regional index’s price earnings ratio has climbed from 11x to 15x earnings over the same period.

EOFF’s portfolio continues to compound at a rate that is far superior to that of the Asian universe. It is also noteworthy that, in aggregate, the Fund’s portfolio remains debt free.We are confident that we can repeat our overperformance over the next five years.

Henry Thornton

Fund Manager, EPIC Oriental Focus Fund