EPIC Oriental Focus Fund: A highly profitable and fast growing portfolio

EPIC Oriental Focus Fund

April 2024

A highly profitable and fast growing portfolio

This article updates two previous articles published last year which highlighted the underlying profitability of the holdings in the EPIC Oriental Focus Fund (“EOFF” or, the “Fund”). The data is sourced from Bloomberg.

Profitability

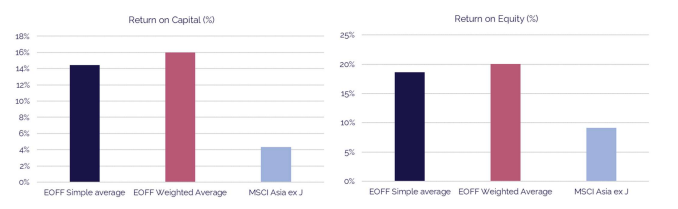

The charts above reconfirm the vastly superior profitability of the Fund’s portfolio compared to the Asian universe. The weighted average return on equity of the portfolio is 20.1% (as at 12 March 2024), more than double the 9.1% return on equity of the MSCI Asia ex Japan Index. EOFF’s weighted return on capital, at 16.1%, is almost four times higher than that of the index (4.3%).

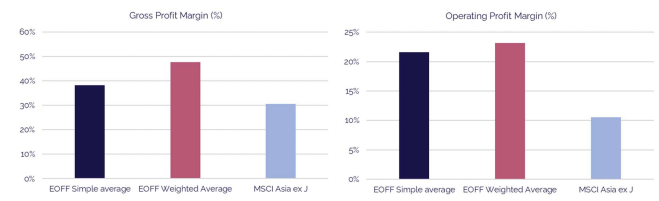

Unsurprisingly this superior profitability is evident in margins. The Fund’s weighted operating profit margin of 23.2% is more than twice that of the universe (9.3%), while its 47.7% gross profit margin exceeds the universe’s average of 30.6% by a considerable distance.

The fact that the simple average numbers on these metrics for the portfolio are lower than the weighted average confirms that our larger, higher conviction holdings have a superior profitability profile. This is as one would expect. The top ten holdings accounted for 55.8% of the portfolio on 12 March 2024. The average holding period for these stocks is five years and ten months.

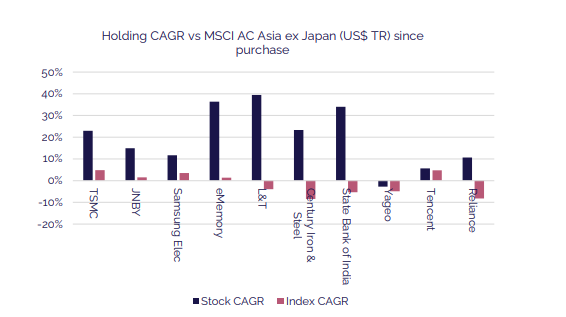

The chart above shows the returns of each of the largest ten holdings of the Fund since purchase, together with the returns of the index. It is notable that the four large ‘index’ holdings (TSMC, Samsung, Tencent and Reliance) have all generated some decent outperformance but the real winners have been the non-index stocks.

Growth

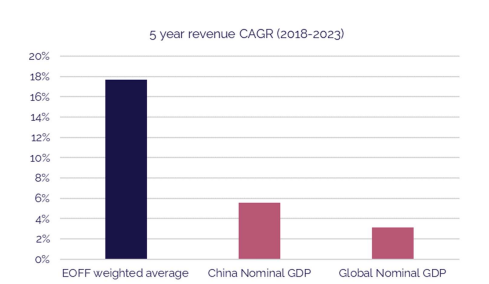

In addition to profitability, we remain very focussed on the potential growth of each and every portfolio holding. The following chart shows the five year revenue CAGR of the weighted average of the EOFF portfolio and Global and Chinese nominal GDP. We cannot source the revenue data for the Asia ex Japan universe but growth in nominal GDP over the period seems a reasonable comparator. The weighted average of the portfolio has compounded at 17.7%, considerably faster than either Chinese or Global GDP (5.54% and 3.11% respectively). This period covers the COVID era, the most difficult period for corporates to navigate since the Global Financial Crisis.

Conclusion

The EPIC Oriental Focus Fund trades on 24.4x current year earnings and 16.7x forward earnings as per our internal calculations as at 27 February 2024. This is not a ‘cheap’ portfolio by comparison with the MSCI Asia ex Japan Index which trades on 16.9x current year earnings and 12.4x forward earnings as at 29 February 2024.

The important difference is that EOFF’s portfolio is compounding at a rate which is far superior to that of the MSCI Asia ex Japan Index. In aggregate it is noteworthy that the Fund’s portfolio is also debt free.

To quote Albert Einstein yet again “compound interest is the eighth wonder of the world. He who understands it, earns it…he who doesn't… pays it.”

Henry Thornton

Fund Manager, EPIC Oriental Focus Fund