EPIC Multi Asset: Progressive Portfolio Theory and Decumulation

EPIC Multi Asset

March 2024

A Regime Shift

Equity/bond correlations turned positive in 2022 and have remained positive meaning that bonds may no longer be an effective diversifier for portfolios.

Since 2000, equities and bonds have been negatively correlated. When equities fell in price, bond prices tended to move in the opposite direction and rise. This made bonds a very important and effective component of a diversified portfolio. The traditional construction of portfolios of 60% equities and 40% bonds performed very well throughout the period 2000 to 2021.

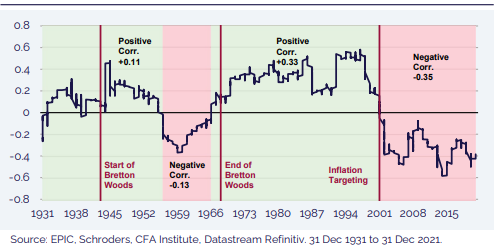

However, this has not always been the case. Looking at the equity-bond correlation pre-2001, it is apparent that equities and bonds have gone through ‘regimes’ of negative and positive correlation, with cycles lasting decades. Figure 1 shows the five-year rolling correlation of returns between US equities and 10-year US Treasuries. The chart shows distinct regimes over time. The extended durations of these cycles, as well as the inherent biases of short-termism, mean the potential for regime shifts can be disregarded. However, changes from negative to positive correlation, or vice versa, do happen.

Figure 1: 5-Year Rolling Equity/Bond Correlation History

Investors tend to suffer from recency bias, which supports the prevailing consensus that the current regime will not change and that opposite regimes will not persist for long periods. Modern portfolio construction is founded on the “truth” that equities and bonds are negatively correlated. However, the chart above contradicts this philosophy, illustrating that the opposite relationship can persist for long periods. At the risk of us telling you ‘This time it’s different!’ we ran the data over a more recent period, and on a two-year rolling correlation, to highlight that we may be moving back to a positive correlation regime, now that we have a level of inflation not seen since 2009.

Figure 2: 24-Month Rolling Equity/Bond Correlation

The new positive correlation regime may have begun in 2022, as correlations moved from negative to positive (Figure 2). That means equities and bonds both rise and fall together in price-terms, and in 2022 most low-risk portfolios fell as much as high-risk portfolios. Specifically, this created a major problem for retirement clients who were in lower-risk, bond-heavy strategies,but who could not afford to suffer significant drawdowns in the value of their portfolios.

Figure 3: 2022 Global Equity and Bond Performance

The Impact of a Significant Drawdown

If history is our guide, a positive equity-bond correlation is likely to persist for longer than expected.

It is pertinent to concentrate on the potential consequences of a change in this fundamental assumption of portfolio construction over the last 20 years.

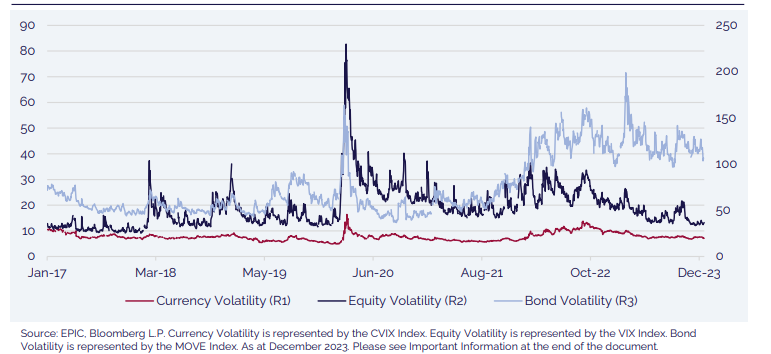

The other significant market characteristic resulting from the shocks of COVID and the war in Ukraine is the elevated level of price volatility throughout traditional asset markets. Figure 4 illustrates that volatility has been at a higher baseline across equities, bonds, and currencies relative to pre-COVID levels. This has understandably been due to the uncertainty around the growth and inflation outlooks and the subsequent effects on monetary and fiscal policy, which are likely to remain prominent in the medium term.

With volatility across asset classes settling to trend levels that are, on average, higher than pre-COVID levels, the sequencing risk faced by investors has increased substantially. Sequencing risk is the threat that the value of a client’s portfolio cannot keep up with their retirement income needs, due to a sequence of poor market returns. The client makes withdrawals when values are low, i.e. selling into a falling market and crystallising irrecoverable losses in value.

Figure 4: Equity, Bond and Currency Volatility Since 2017

Sequencing and Drawdown Risks

Higher return volatility increases the chance of experiencing a sequence of poor returns. It is most detrimental at the beginning of the decumulation or retirement period but can have a negative effect at any time during the decumulation phase.

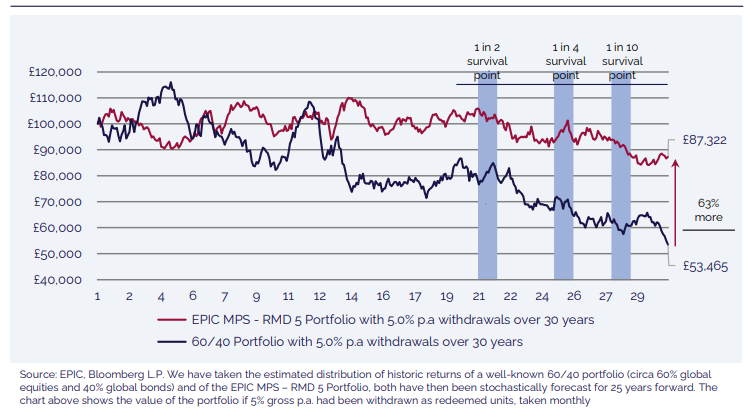

The effect of sequencing risk is to reduce the value of the capital remaining by up to 63% by the end of a typical retirement period. The shortfall due to sequencing risk is equivalent to reducing the retirement duration by up to approximately 14 years for every £100k invested.

Figure 5: Effect of Sequencing Risk on Pension Portfolios

The characteristics of retirement are in stark contrast to the preceding years. Clients require regular withdrawals and rarely top-up their savings. The metaphoric bathtub that is filled up over a lifetime of accumulating assets, can no longer be added to. Instead, the bathplug is pulled and its contents start decreasing. The focus shifts from growing wealth to sequencing and drawdown risks. Risk characteristics need to be managed much more regularly than with accumulation solutions.

EPIC’s Risk Managed Decumulation 5 Model Portfolio is designed specifically to deliver around 5% gross income to clients while preserving their hard-earned capital. There is flexibility to increase the level of income should the client wish to run down their pension at any time. The portfolio focuses on monthly risk over annual risk, and the management of the portfolio is designed to mitigate the all-important sequencing and drawdown risks when in, or approaching, retirement.

First line of defence – portfolio construction:

- Lower Fixed Income allocation – reducing risk of short-term correlation with equities and over-exposure to duration risk.

- No exposure to illiquid assets such as physical property – reducing liquidity gating risk.

- Tactical use of cash – providing short-term downside protection.

- Liquid uncorrelated strategies – providing effective portfolio diversification.

Second line of defence – rules based approach to risk:

- Closely monitoring monthly volatility and Value at Risk – minimising risk of severe drawdowns.

- Frequent rebalancing – to maximise the risk/reward ratio of the portfolio.

- Mechanistic de/re-risking – to remove human biases and protect against market stress.

Please contact us if you are interested in hearing more about EPIC’s Risk Managed Decumulation Solution or wish to discuss Multi Asset more broadly.