EPIC Oriental Focus Fund: A highly profitable and fast growing portfolio

EPIC Oriental Focus Fund

September 2024

Lower interest rates, a weaker Dollar and a developing focus on shareholder returns

It has been a difficult period for the Asia ex Japan asset class. The restrictive monetary policy pursued by the Federal Reserve and other Western central banks over the past two and a half years was a predictable and obvious consequence of the explosion in monetary growth in the US and Europe during the COVID period. Getting the inflation ‘genie’ back in the bottle was further complicated by the Russian/Ukraine conflict but the prescription of tighter monetary policy and higher rates appears, at last, to have worked.

This is absolutely crucial for the outlook for Asia ex Japan where the monetary spigots were never turned on during COVID and inflation rates across the region remained remarkably subdued. The enemy across Asia remains deflation not inflation.

Markets are now pricing in multiple cuts in US short term rates as we move towards 2025.

Historically, falling US interest rates and a weaker Dollar have proved to be very fertile times for Asian investors. While the growing economic conflicts between the West and China, coupled with the reshoring of production following the COVID-inspired supply chain havoc, present issues we believe it is very reasonable to expect better returns across the Asian ex Japan asset class over the next year or two.

In addition, a distinctly sharper focus on shareholder returns across the region is evident. Alibaba, Tencent, AIA – to name just three portfolio holdings – are shovelling cash back to shareholders via share buybacks while JNBY’s dividend payout ratio for the financial year to June 2024 climbed to 98%.

EPIC Oriental Focus Fund has a highly profitable and fast growing portfolio

This article updates three earlier articles published over the past year or so which have highlighted the underlying profitability of the holdings in the EPIC Oriental Focus Fund (“EOFF” or, the “Fund”). The data is sourced from Bloomberg

as at 30 August 2024.

Profitability

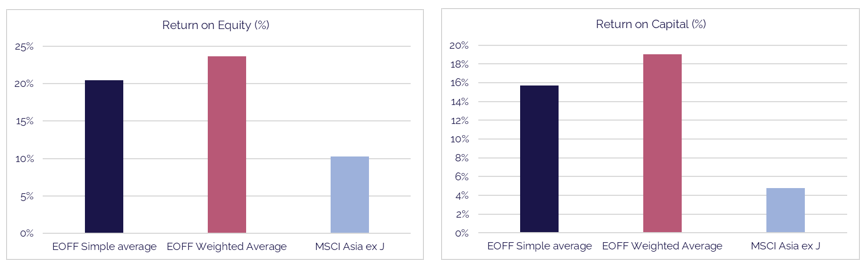

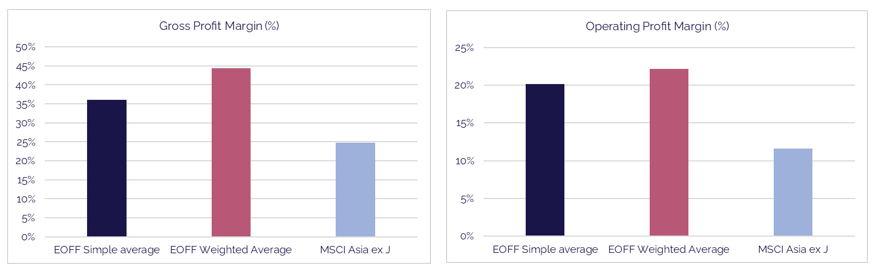

The charts above reconfirm the vastly superior profitability of the Fund’s portfolio compared to the Asian universe. The weighted average return on equity of the portfolio is 23.6%, comfortably more than double the 10.2% return on equity of the MSCI Asia ex Japan Index while EOFF’s weighted return on capital, at 19.0%, is nearly four times higher than that of the index (4.8%).

Unsurprisingly this superior profitability is evident in margins. The Fund’s weighted operating profit margin of 22.1% is close to twice that of the universe (11.6%) while the 44.4% gross profit margin exceeds the universe’s average of 24.7% by a considerable distance.

The fact that the simple average numbers on these metrics for the portfolio are lower than the weighted average confirms that our larger, higher conviction, holdings have a superior profitability profile. This is as one would expect. The top ten holdings account for some 58% of the portfolio while the average holding period for these ten stocks is over six years.

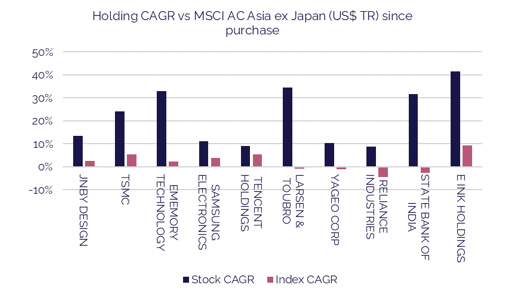

The chart above shows the returns of each of the largest ten holdings of the Fund since purchase, together with the returns of the index. It is notable that the four large ‘index’ holdings (TSMC, Samsung, Tencent and Reliance) have all generated some decent outperformance but the real winners have been the non-index heavy stocks. eMemory, E Ink and Larsen & Toubro stand out. On average these top ten holding have outperformed by 20% annually since purchase.

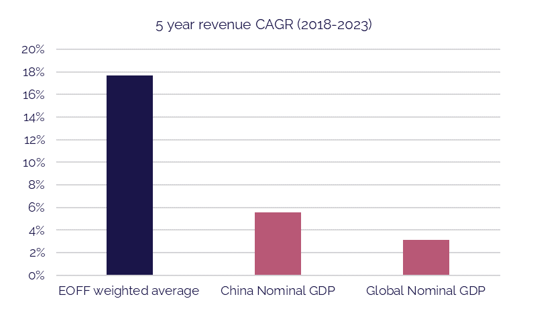

Growth

In addition to profitability, we stay very focussed on the potential growth of every portfolio holding. The following chart shows the five year revenue CAGR of the weighted average of the EOFF portfolio and Global and Chinese nominal GDP. We cannot source the revenue data for the Asia ex Japan universe but growth in nominal GDP over the period seems a reasonable comparator. The weighted average of the portfolio has compounded at 17.7%, significantly faster than either Chinese or Global nominal GDP (5.54% and 3.11% respectively). This period covers the COVID era, the most difficult period for corporates to navigate since the Global Financial Crisis.

Conclusion

The EPIC Oriental Focus Fund is not a cheap portfolio per se. The underlying portfolio trades on circa 23x current year earnings which looks expensive relative to the universe.

The far, far more significant factor is that the portfolio is compounding at a rate that is hugely superior to that of the Asian universe. It is also noteworthy that, in aggregate, the Fund’s portfolio is debt free. We would be very happy to answer any questions on the outlook for the asset class and also any questions that arise from this analysis.

Henry Thornton

Fund Manager, EPIC Oriental Focus Fund