Fixed Income : Emerging Markets - A Resilient Haven in a Global Trade War

The global economic landscape is shifting rapidly, with rising trade tensions—especially between the US and China—casting a long shadow over global growth. These disruptions threaten to upend trade flows, inflate costs, and stall economic momentum. In this climate of uncertainty, investors seeking stability and opportunity must look beyond traditional safe havens. Emerging markets, with their fiscal discipline and growth potential, stand out as resilient and attractive destinations.

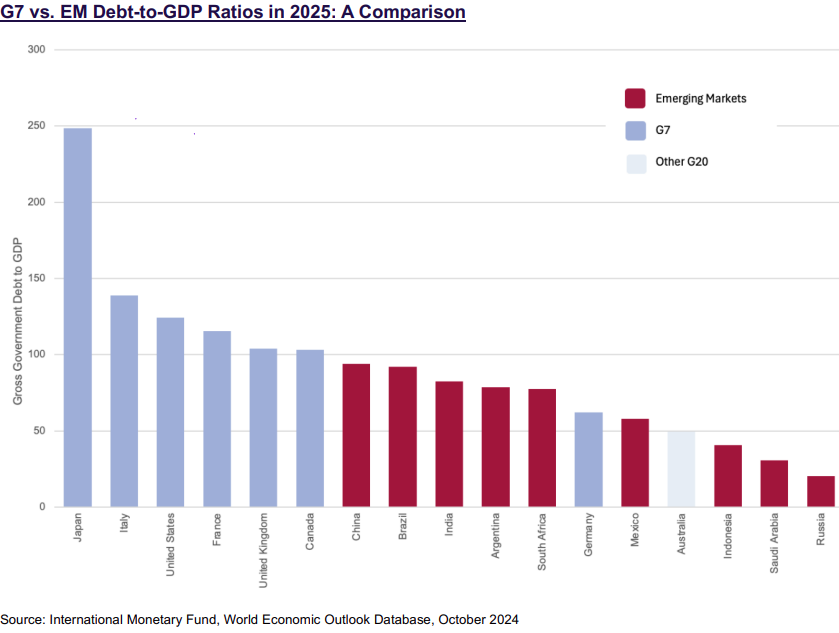

A critical factor underpinning the resilience of emerging markets is their comparatively lower debt levels. While developed economies grapple with surging debt burdens and limited fiscal flexibility, many emerging nations have embraced fiscal prudence, enabling them to weather economic shocks more effectively. This stark contrast is evident when examining government debt-to-GDP ratios.

These figures highlight the significant advantage that emerging markets hold in a world increasingly burdened by debt. Lower debt levels provide greater flexibility to respond to economic shocks and implement counter-cyclical measures, making these economies more resilient in the face of global headwinds.

History has shown that trade wars rarely have winners. As tariffs escalate, businesses face higher costs, consumers bear the brunt of increased prices and global trade flows dwindle. However, this disruption, which can lead to a slowdown in economic growth, makes bonds a particularly attractive asset class.

In a trade war scenario, emerging market bonds offer several compelling advantages:

- Lower debt, lower risk: lower debt levels translate to lower default risk, making emerging market bonds a safer bet in times of economic uncertainty.

- Higher yields: many emerging market bonds offer higher yields compared to their developed market counterparts, providing investors with greater income potential.

- Diversification: Undervalued EM bonds deliver idiosyncratic returns, uncorrelated with developed market trends.

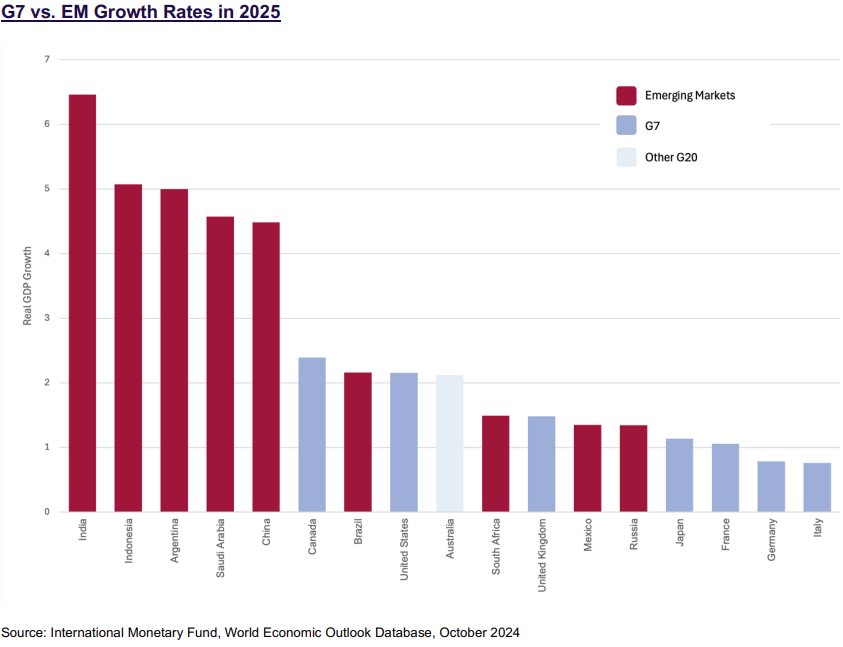

Emerging markets are also better placed for stronger growth. The IMF's 2025 GDP growth forecasts paint a clear picture.

The emerging market countries in the chart above exhibit an average growth rate of 3.5%, significantly outpacing the G7’s projected 1.4%. Demographics play a central role in this divergence, with many EM nations, such as India and Indonesia, benefiting from younger populations and expanding labour forces. By contrast, countries like Italy, Germany, and Japan face aging populations and shrinking workforces, which weigh on growth.

Additionally, EM countries often experience rapid urbanisation and industrialisation, as seen in India and Brazil, which drives investment and productivity gains. Conversely, developed economies like the United Kingdom, Canada, and the United States tend to have more mature markets and slower growth trajectories. These structural factors highlight why EM countries often grow faster, even as challenges like governance and volatility remain.

CFE: an undervalued opportunity in Mexico

One example of the potential within emerging market bonds is Comisión Federal de Electricidad (CFE), Mexico's state-owned electric utility. CFE's bonds offer an attractive combination of factors:

- Investment grade rating: CFE holds investment-grade ratings from Moody's (Baa2), Fitch (BBB-) and S&P (BBB), indicating moderate credit risk.

- Government support: a state-owned entity, CFE benefits from implicit government backing, further mitigating default risk.

- Attractive valuation: CFE bonds currently trade at a significant spread over comparable US Treasuries, suggesting undervaluation and potential for price appreciation.

- Sustainable credentials: CFE's sustainability bonds adhere to international principles such as the Green Bond Principles (GBP) and Social Bond Principles (SBP), ensuring transparency, accountability and alignment with sustainability frameworks such as the United Nations Sustainable Development Goals (SDGs).

For example, the 2052 bonds trade at a spread of 291 basis points over US Treasuries1. Our estimate of fair value is 129 basis points (bps). To put this into perspective the spread on the Bloomberg US High Yield Index trades at 264 bps. Whilst there is a duration difference (CFE is 11.29 versus 3.01) that difference works to our advantage in a world where yields are likely to decline. Even if a decline in treasury yields is ignored for the moment, if the CFE 52’s were to trade to fair value over the next 12 months, it would generate a total return of 26.03% when the yield is considered. Each 50 bps decline in US treasury yields would add another 7% to the return.

What makes the 2052 bonds particularly interesting is that they adhere to ESG principles. These bonds integrate both green objectives (e.g. renewable energy, energy efficiency and clean transportation) and social objectives (e.g. reducing inequalities and providing access to basic services like electricity and internet). Such bonds usually trade expensively compared to the rest of the market, but these bonds remain cheap.

Where to position in the current environment?

While past performance does not guarantee future returns, the substantial outperformance of emerging market bonds in 2017 during a period of rising trade tensions offers a historical perspective. For instance, in the first year of Trump's presidency, the Bloomberg EM Global Agg Index outperformed the Bloomberg Global Agg Index by a considerable margin (8.17% vs. 3.04%).

Notably, the current yield environment in emerging markets is significantly higher than in 2016 (6.55% currently compared to 5.05% at the end of 2016). This higher starting yield, combined with the potential for interest rate cuts in a slowing global economy, provides more scope for capital gains.

Uncertain markets offer opportunities. Emerging markets, with solid fundamentals, manageable debt, and attractive yields, offer diversification and value. Mexico's CFE is particularly undervalued. While emerging market bonds are favourably price compared to credit globally, particularly US credits, CFE's valuation is suppressed by perceptions of company and regulatory issues in Mexico's energy sector, including potential impacts from US tariffs.

US tariffs on Mexican goods could impact CFE's costs and project timelines, depending on the specific goods targeted. However, as a state-owned company, CFE's valuation is more closely tied to politics and regulation. Under President Sheinbaum, energy policy prioritizes state-controlled power generation, with CFE maintaining a 54% market share while private firms operate under regulation with the remaining 46%. She has also pledged to significantly expand Mexico's renewable energy capacity, which could improve investor sentiment toward CFE over time.

Despite these challenges—including potential tariff impacts—CFE’s dominant role in Mexico’s energy sector, its control over generation, and its growth potential in green investments suggest that the market may be undervaluing its prospects. For investors willing to navigate Mexico’s evolving regulatory landscape, Sheinbaum’s energy policies and the potential effects of US tariffs, CFE’s current valuation presents an attractive opportunity.

Disclaimer: This document is for informational purposes only and does not constitute legal, tax, or investment advice. Prospective investors are strongly encouraged to consult their own professional advisers regarding the legal, tax, financial, or other consequences of investing in any products or services described herein

1 Notes: Yields and spreads correct as at 31st January 2025